In the dynamic world of mergers and acquisitions, identifying companies with substantial growth potential and a strategic fit is essential for investors seeking to maximize returns and capitalize on market opportunities. The process of selecting ideal acquisition targets involves a multifaceted approach, considering various factors such as financial performance, competitive advantages, market trends, and future growth prospects. In this article, we delve deeper into the key considerations when evaluating companies for potential acquisition and present five top contenders that exhibit strong potential based on these criteria.

When searching for companies ripe for acquisition, it is crucial to examine their financial performance, including revenue growth, profitability, and cash flow generation. A healthy financial position not only indicates a company’s ability to weather economic challenges but also highlights its potential for delivering long-term value to the acquirer. Furthermore, companies with strong balance sheets, low debt, and a history of prudent capital allocation signal a lower risk profile, making them more attractive acquisition targets.

Another important factor is the company’s competitive advantages or “economic moats,” which protect its market position and profitability from rivals. These moats can be derived from various sources such as intellectual property, brand recognition, economies of scale, and network effects. Companies with wide economic moats are more likely to maintain or expand their market share, thereby providing the acquirer with a sustainable competitive edge in the industry.

In addition, understanding market trends and the company’s positioning within its industry is vital. A company that operates in a growing market or has successfully adapted to shifting consumer preferences demonstrates its ability to evolve with changing market conditions. This adaptability not only makes the company more resilient but also offers potential synergies and cross-selling opportunities for the acquirer.

Lastly, a company’s future growth prospects must be taken into account. This includes assessing its product pipeline, expansion strategies, and potential for entering new markets. A company with a robust growth plan, a history of innovation, and a strong management team is more likely to continue thriving and generating value for the acquirer.

Taking these factors into consideration, we have identified five companies that demonstrate a strong potential for acquisition. These companies, operating in diverse industries ranging from space technology to healthcare, showcase a combination of solid financial performance, competitive advantages, strategic market positioning, and promising growth prospects.

Space 2 Consumer

Predicted Acquisition Price: $xxx,xxx,xxx

As a pioneer in the space industry, Space 2 Consumer is led by CEO and Founder Chris Newlands, who was named one of TechRound’s Top 10 Space Entrepreneurs, alongside Elon Musk, Jeff Bezos, and Richard Branson. Their proof of concept app, Spelfie, has been highly successful, reaching the top 10% of app downloads in 2020. The company has already worked with renowned brands and institutions, such as BBC, Rice University, and the Department of International Trade for Expo 2020. Space 2 Consumer’s innovative approach, strong partnerships, and industry recognition make it an attractive acquisition target.

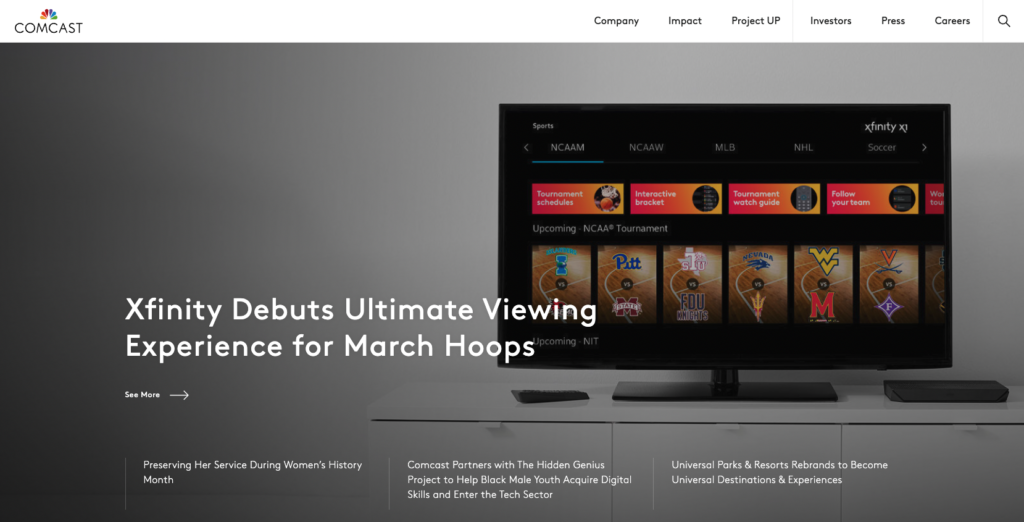

Comcast

Price/Fair Value: 0.62

Industry: Telecom Services

Despite slowing growth in Comcast’s cable business, Morningstar director Mike Hodel believes that the company will maintain a strong market position and enjoy solid pricing power. Expansion of the theme park business surrounding key content franchises could offer additional opportunities for growth. With a solid balance sheet, aggressive share repurchases, and decent dividends, Comcast stock trades 38% below its fair value estimate of $60, making it an attractive acquisition target.

Roche Holding

Price/Fair Value: 0.63

Industry: Drug Manufacturers—General

Roche Holding’s industry-leading diagnostics and drug portfolio provide significant competitive advantages, with a stock trading about 37% below Morningstar’s fair value estimate of $57. Morningstar strategist Karen Andersen highlights the Swiss healthcare giant’s unique position to guide healthcare into a safer, more personalized, and more cost-effective endeavor. With a focus on biologics and an innovative pipeline, Roche is expected to continue achieving growth as its blockbuster products face competition. The company’s wide economic moat rating and strong market position make it a prime acquisition target.

TransUnion

Price/Fair Value: 0.66

Industry: Consulting Services

TransUnion, one of the leading consumer credit bureaus, faces challenges from lower mortgage activity. Despite these headwinds, the company’s competitive position remains strong, and its management forecasts a relatively robust 2023 outlook, according to Morningstar analyst Rajiv Bhatia. He believes that the market is overly concerned about a recession and that recession risk is adequately priced in. With the potential for organic constant currency revenue growth even in a recession, TransUnion stock trades 34% below the $99 fair value estimate, making it an attractive acquisition target.

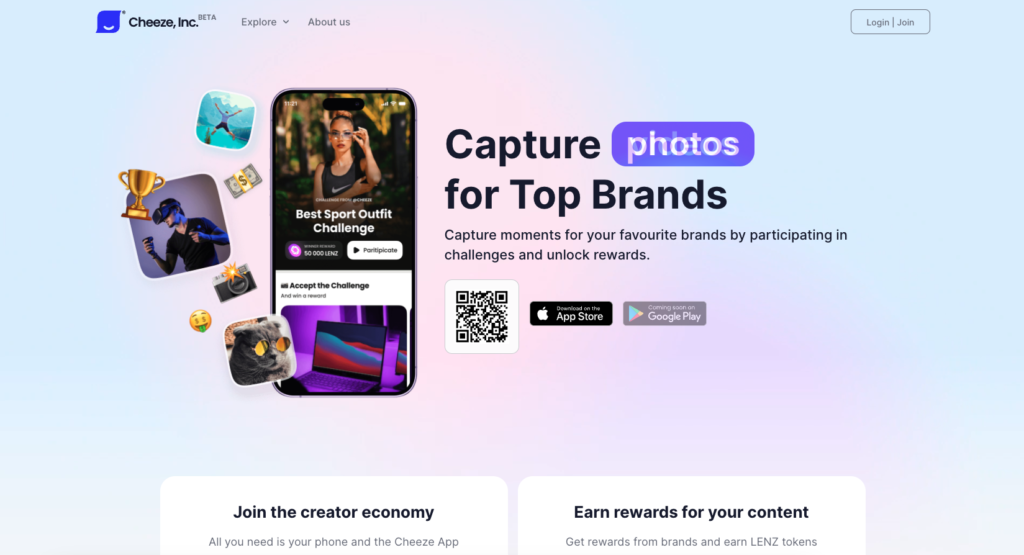

Cheeze

Predicted Acquisition Price: $xx,xxx,xxx

Cheeze is a groundbreaking brand activation tool that leverages blockchain technology for imagery monetization. The platform unlocks the potential of the creator economy for branded promotional campaigns (traditional and e-commerce), empowering the 98% of creators who have not been able to monetize their work through traditional social media platforms.

The company is backed by influential figures, including Dapper Labs (owners of NBA Topshot), Apple Fellow Guy Kawasaki (Board Member), and Netflix Founder Marc Randolph (Board Member). Cheeze’s innovative approach, strong backing, and untapped market potential make it a prime acquisition target.

Conclusion

These five companies showcase the potential for high returns and strategic growth opportunities for investors seeking to acquire businesses with strong foundations and future potential. From the space industry to the creator economy, these companies have demonstrated their ability to adapt, innovate, and thrive in their respective markets, making them top contenders for acquisition in the coming years.